I can't seem to find an agent or a company that understands what "mid-century" items even are! I want to cover my items (I use them) such as chairs, lamps, pottery, etc. I want to cover them against theft, fire, basic catastrophic loss. ALL I get is to list the items and then cover them as an "antique" and then NOT use them-I can't seem to find BLANKET coverage, I can not also seem to find an agent that even understand what an item is-ex. a Knoll Bertioa chair, when I say I have a chair about 30 to 40 years old, I am asked why I would even insure it???? My husband and I can't be the only people with this issue!! I DID read the other thread about INSURANCE that mentions the Chubb group and I have a call into them. We live in PA-we rent an apt. I assume if we live in NYC or Philly maybe we would have better luck. I have called over a dozen BIG name insurers, I have been told to look into special insurance (but no one gives you ANY names) such as those that insure antique cars- BUT I want to cover Mid-century treasures! I want to use my vintage Brookpark dishes and sit in my Eames chair- I just want theft and fire insurance-not for when I break a dish!! Does any one have any idea where to turn????? Thanks

I don't know if this is possible for you...

...but if you are the child or grandchild or parent or grandparent of someone who has served in the military, you might look into getting coverage with USAA. Their website is at www.usaa.com -- you can check your elligibility there. I know that USAA does offer insurance for antiques and maybe they won't be so dense when you bring up your mid-century modern pieces that will need extra coverage (given what they sell for).

I have no experience dealing with Chubb, so I can't help you there...sorry!

reply/insurance

thanks, but USAA in not a option

We really are having trouble finding a company that does not want to "schedule" each items. IF we had all brand new items they would replace should a major fire or theft happen at 100%, where it get hard is that the insurance companies what to shedule these older items then in our case (Erie) does not want us to use the item, other-wise if some thing should happen they seem to feel that our older items are not of value. We are looking for farir market value for replacement of older items and we have yet to find a ANY company. We didn't know this was a problem until we read the fine print on our ploicy and found out that items over 25 years do not receive replacement value, unless they are "scheduled", I wonder how many other people think their items are insured and really are not?

Do I get a ribbon for resurrecting the oldest thread?

Just curious how people here are (or are not) insuring their personal mid-century collection. I have an Allstate home insurance policy that covers possessions up to 75% of the dwelling cost. However, I haven't identified any specific "prized possessions" items, which would have coverage up to $10k apiece.

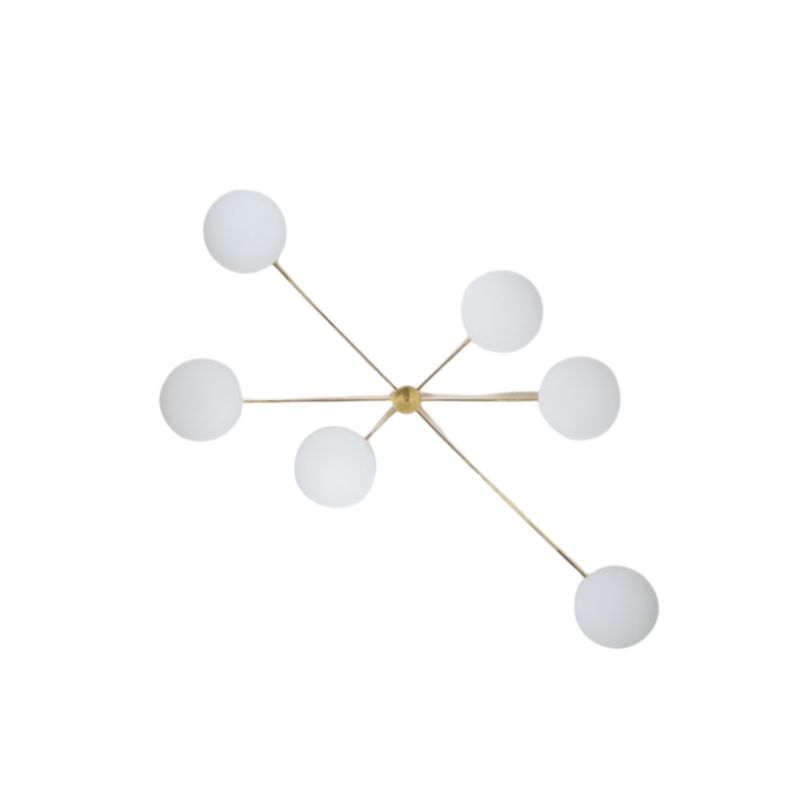

I have between 20-30 furniture pieces, whose individual prices fall in a reasonable retail price range of $200 - $2500. So total value is well under the max limit. However, how does replacement value get calculated for mid century pieces, which fall between new replacements and the traditional definition of antique furniture? Some items are currently only available on 1stDibs store. Do those listings then set the replacement value (which would then exceed $2500 in a few cases)?

I am planning on contacting Allstate directly, but just wanted to get a sense how others are approaching this. Are you itemizing pieces with values less than $10k (or $2k)?

Although I do sell a few things here and there, all my stuff is pretty much for personal use rather than business inventory.

Thanks.

I actually use about 95% of my mid-century furniture/furnishings in my house (not including project pieces awaiting fixin' up in the basement), so it's not really business inventory. I try to rotate newly acquired pieces into various rooms, and then sell what they replaced, in order to avoid having too much stuff lying around.

So I'm really looking at this from a home-owner's perspective, although one with constantly-changing pieces.

What are the downsides of insuring them as business inventory? (I think most insurers assume furniture has very little residual value once off the showroom floor, and regardless the home owner is very unlikely to sell it anyway, so from this point of view, your furniture is much near to business inventory anyway).

Can't you just get your stuff appraised by someone who appraises MCM era things? There are plenty of people who do that and they may even do it from photos and descriptions for all I know. Insurance companies accept appraisals from outside experts when determining value and how much coverage you'll need.

I guess the underlying question I have is whether I need to itemize my personal mid century collection to the insurance company at this stage. I have always assumed that if a fire destroyed my house, I would simply list the items that were lost and their reasonable replacement cost (whether it was a new chair from Room and Board or a vintage chair acquired from eBay), and Allstate would cut me check. However, I don't have any firsthand experience of how insurance companies value vintage furniture.

You really need to contact your Allstate agent. I just recently purchased a home with my fiance and there were various options to choose from (I have Liberty Mutual) for personal property and replacement value costs. The way it worked with LM was that the property / replacement value is dependent on the number of main rooms (living, kitchen, bedrooms etc.) in the house times the estimated value of furniture per room. At the end of the day it's all under one limit so you could simply add up the value of your pieces and divide them by the number of main rooms and come up with the estimated value per room. Hope that helps.

I'm not an insurance agent, but I'll tell you what mine told me. You need to maintain a full inventory of all your personal items that have value above average used furniture cost - typically you need not just a list of items but pictures to prove ownership and condition. If you don't have that, then you can use receipts for what you paid. If those receipts are from Goodwill, then that is their value unless you can show otherwise. You don't need to get an appraisal before hand, as long as you have good evidence (pictures), but an appraisal is even better IF you get an independent appraiser. Obviously its important that you don't get appraisals from your business partner or sister-in-law.

If you don't have any of the above, then you'll get used furniture value - much less than you probably imagine your items are worth.

If you need any help, please contact us at – info@designaddict.com